Frequently Asked Questions

How much refund I can Get?

Your chances of getting a refund depend on a few factors.

As explained in the German income tax system, you are likely to get a refund with conditions

- Have business expenses (Verbungskosten) more than 1000 euros per year

- You have worked for some months in Germany and the rest of the year in other countries where income is lower (global income)

- You have provided financial support to your needy dependents (parents/spouse/children etc.) and hence are eligible for deduction (Unterhalt)

- You changed your tax bracket during the year because you got married. (tax class change)

- You have paid rent in Germany and India (double household)

- You came to India to meet your family, maintain your household and pay for air tickets. (double family)

- You have children and your income exceeds EUR 60000 per year and you will therefore benefit more from the Kinderfreibetrag than from the monthly Kindergeld (Kinderfreibetrag).

Note: Kindergeld should be applied in any situation. Profits above the Kindergeld will be paid by the tax office. The Kindegeld will not be paid by the tax office.

- You have children and have expenses for their education, kindergarten, etc.

The more conditions you fulfill, the greater your chances of getting a refund.

The exact amount of refund will depend on the individual conditions.

How much time it takes to get refund?

After filing your tax return with Finanzamat, it takes 1-2 months for the refund money to appear in your account. Sometimes it may take more time.

With our consultancy, the money will be deposited directly into your account by Finjamat. (German and Indian account). It may take an additional month for Indian accounts.

Last date for filing tax return

If you are entitled to get a refund from the tax office, you can apply for the return in the next 4 years. Therefore, it is possible to apply the tax returns of the years 2020, 2021, 2022 and 2024 in the current year 2023.

However, if the taxpayer has to pay tax then he should file the tax return before 31st July of the next year.

The deadline for the 2023 declaration is August 31, 2024.

What are the legal tax savings ways?

Business expenses (Werbungskosten)

The most common tax-deductible costs belong to income-related expenses (Werbungskosten) which include all expenses that arise from your profession. These include (but aren’t limited to) commuting costs, business trips, further education, costs for work clothes, setting up a home office, professional insurances, and job applications. Income-related expenses are legally defined as “expenses incurred to acquire, secure, and maintain income” (§9 EStG).

A lump sum of 1,000 euros per year is automatically deducted for income-related expenses. As of 2022, this lump sum will be definitively increased to 1,200 euros per year. No evidence is required for this lump sum. If you wish to claim more expenses that exceed this lump sum, you will have to provide proof.

Deductible income-related expenses

• Moving costs

• Double household management (if you have a second residence for professional reasons)

• Telephone and internet costs

• Business trip costs

• Commuting allowance (Entfernungspauschale)

• Job application costs

• Contributions to professional associations (Berufsverbände)

• Costs for a work room in your home (häusliches Arbeitszimmer)

• Work equipment and materials (Arbeitsmittel)

• Costs for further education

• Home Office Lump Sum (Home-Office-Pauschale) from 2020

• etc.

Special expenses, extraordinary expenses, and household-related expenses

Deductible special expenses (Sonderausgaben) include:

• Church tax

• Donations & membership contributions

• Costs for career-related education

• Provisional expenses such as retirement contributions of contributions to health or nursing insurance

• Alimony payments to an ex-spouse

• etc.

Extraordinary expenses (außergewöhnliche Belastungen) include:

• Costs for medicine and therapies

• Expenses for commutes to your doctor

• Nursing care expenses for your parents

• Maintenance payments to dependents

• Expenses related to a disability

• etc.

Household-related expenses (haushaltsnahe Dienstleistungen) include:

• Pet care

• Tradespeople expenses

• Personnel costs for your annual utility bill

• etc.

Required documents/information for filing tax return

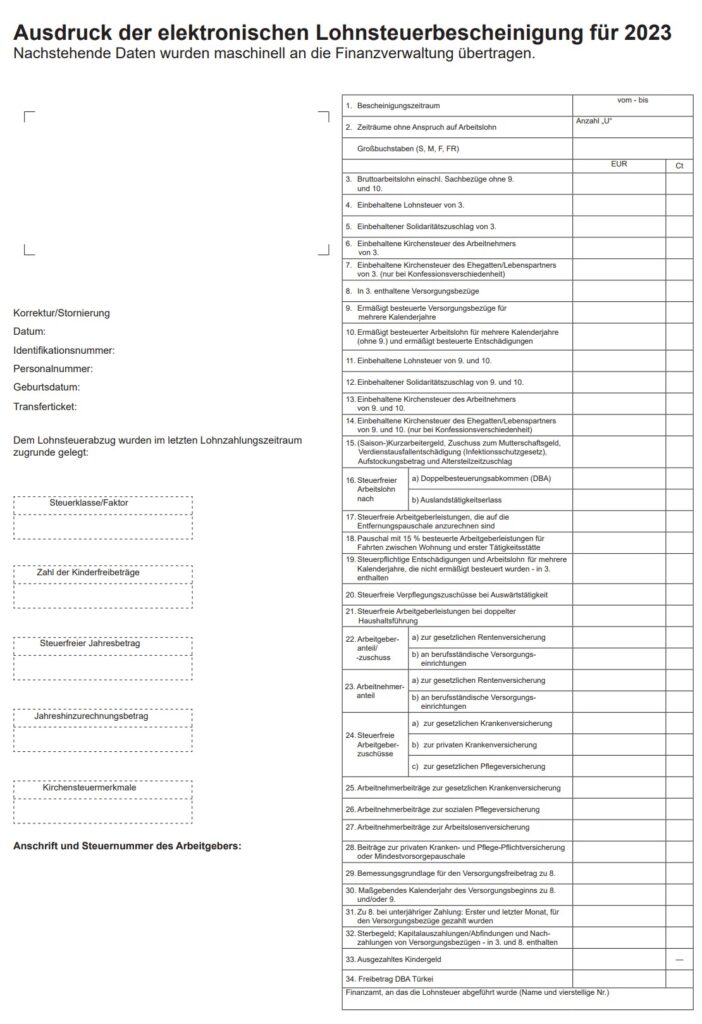

1. Lohnsteuerbescheinigung (This is your annual income statement from employment, you can get this from your employer. It is equivalent of Form16 of India) (You can click on the name to know how it looks like)

2. Identifikationsnummer: (11 digit unique number) and name your Finanzamt. (“Bescheinigung für der lohnsteuerabzug” has these details)

3. Steuernummer :(If you have filed your German tax return previous year, you can find it on your Assessment order (SteuerBescheid) from finanzamt.)

4. Bank account details: German bank account details for refund purpose (Konto-Nr, BLZ, IBAN, BIC) OR Indian account details if you don’t have German Account.

5. Proof of income outside Germany: If you worked outside Germany for few months between January to December, then Salary slips of that employment. e.g. you worked June to December in Germany, then salary slips of January to May of India (or wherever you worked) are also required. This is used to determine your tax slab. This income is not taxed twice.

6. Business Expenses for official purpose. for employment related expenses.

7. Double Household, if applicable:

- Proof of house in India (e.g. India house rental agreement, home loan account statement, Sale deed etc.)

- Flight tickets and Boarding passes for which you have paid

- German Rent agreement / Rent receipts / Bank statement showing payment of rent

8. KinderGeld details, if applicable

- Name of child(ren), Date of birth

- Amount and Period for which KinderGeld is received or not received. If kindergeld was rejected, then rejection letter is required.

- Education, Kindergarten expenses

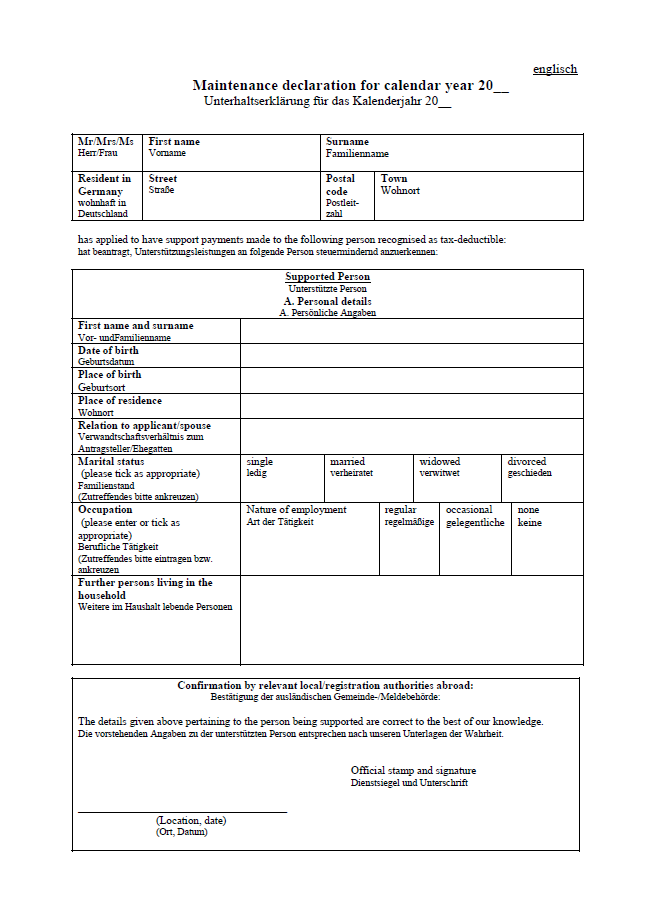

9. Dependent support, if applicable (If your Parents/spouse/child are dependent on you in India and you sent money to them)

- Proof of transfer (Your own German bank account statement with debit and your dependent’s account statement to explain their income source, expenses and financial need)

- Completed form called Unterhaltserklärung for each dependent (given below in attachment), and supporting documents. This form has to be certified by Notary and signed by dependent person.

10. Any other income e.g. Elterngeld, Mutterschaftsgeld etc.

Send an email to us to get excel template of checklist of documents and details.

How to prepare tax return?

Simply Contact us and use our consultancy from the comfort of your home. We provide our services to all over world.

OR

If you are doing it on your own, there is one options to prepare the tax declaration

Use the printed forms : After completing, submit the complete file to Finanzamt (Tax office)

You can expect the refund in 4-8 weeks with us.

Can I get my pension contributions?

Yes, it is possible to get pension contributions. But that it is a separate process and it can be refunded after two years of leaving Germany.